Key benefits:

- predefined real return

- less volatility than nominal bonds

- returns are highly correlated with inflation

- low correlation with other asset classes

Contents

RRB historic yield and CPI data

RRB FAQs

Understanding RRB quotes

Stripped RRBs

RRB Mutual Funds

Taxation of RRBs

Buying and selling RRBs

Canadian Links

US TIPS FAQs

US Links

Euro Links

UK Links

AU Links

IS Links

SE Links

More Links

Retirement Planning Issues

Glossary

Acknowledgements

Footnotes

RRB historic yield and CPI data

|

Bank of Canada Data

Recent Bond Yields [RRBs are at the bottom of the page]Historic Monthly CPI [RRBs are indexed based on Total CPI]

Historic Index Ratios

Independent Market Data

Selected RRB Prices and Yields [Globe Investor]RRB Offer Prices and Yields [CanadianFixedIncome.ca]

DEX Real Return Bond Indices [PC-Bond]

RRB FAQs

How do RRBs work?

How do RRBs work?

Government of Canada Real Return Bonds pay semi-annual interest based on a real (coupon) interest rate. Unlike standard fixed-coupon marketable bonds, interest payments on RRBs are adjusted for changes in the consumer price index (CPI). RRBs give you payments in two different ways:

Government of Canada Real Return Bonds pay semi-annual interest based on a real (coupon) interest rate. Unlike standard fixed-coupon marketable bonds, interest payments on RRBs are adjusted for changes in the consumer price index (CPI). RRBs give you payments in two different ways:

- Interest: Twice a year (June 1 and December 1) you receive a payment for an amount equal to the inflation adjusted principal multiplied by the interest rate.

- Final Payment: The principal or par value is continuously adjusted by an amount equal to the CPI but is payable only when the bond is sold or matures.

Can you give me an example of how this works in practice?

Can you give me an example of how this works in practice?

On a $1,000 bond, if the coupon interest rate is 3% and inflation is 1% after six months, the principal is adjusted to $1,010. You then receive a semi-annual interest payment of $15.15. If inflation rises to 3% by year end, the principal is adjusted to $1,030. You then receive another interest payment of $15.45. Assuming similar inflation over 10 years, you will receive $351.64 in interest payments while the principal will have risen to $1,343.92.

On a $1,000 bond, if the coupon interest rate is 3% and inflation is 1% after six months, the principal is adjusted to $1,010. You then receive a semi-annual interest payment of $15.15. If inflation rises to 3% by year end, the principal is adjusted to $1,030. You then receive another interest payment of $15.45. Assuming similar inflation over 10 years, you will receive $351.64 in interest payments while the principal will have risen to $1,343.92.

From: How Inflation-Indexed Bonds Work

What place do they have in my portfolio?

What place do they have in my portfolio?

Although RRBs are bonds, their inflation-protection feature makes them behave somewhat differently from conventional nominal bonds. RRBs have many of the return characteristics of long-term bonds with the interest rate sensitivity (price volatility) of short-term bonds. Consider using RRBs as a separate asset class that complements a 5-year nominal bond ladder or a medium-term bond fund.

Although RRBs are bonds, their inflation-protection feature makes them behave somewhat differently from conventional nominal bonds. RRBs have many of the return characteristics of long-term bonds with the interest rate sensitivity (price volatility) of short-term bonds. Consider using RRBs as a separate asset class that complements a 5-year nominal bond ladder or a medium-term bond fund.

What are the risks of RRBs?

What are the risks of RRBs?

All securities, including bonds that are guaranteed by the Government of Canada, carry some risks. However, RRBs are among the least risky investments.

All securities, including bonds that are guaranteed by the Government of Canada, carry some risks. However, RRBs are among the least risky investments.

Like nominal fixed-coupon marketable bonds, if you sell an RRB prior to maturity the price you realize will be based on the prevailing interest rate and could be less than what you originally paid.

In addition, if you buy an RRB on the secondary market, it's possible that after a period of deflation you may receive a principal repayment that's based on a lower index ratio than when you bought the bond.

Moreover, even if you buy an RRB at issue, in the unlikely event that there is net deflation over the 30-year holding period, you could receive less than face value. But keep in mind that even if you were to get less than face value at maturity, your purchasing power would still be preserved. Indeed, if you had reinvested the coupons in more RRBs inside a tax-sheltered account, at maturity the purchasing power of your initial investment would have grown significantly.

And, although extremely unlikely, RRB values may also be subject to changes in how the CPI is calculated or even issuer default.

Understanding RRB quotes

How do I determine the price of an RRB?

How do I determine the price of an RRB?

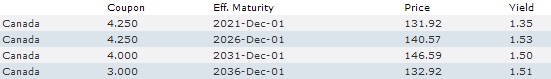

You can obtain the most authoritative RRB pricing by contacting the bond desk at your stock broker. The Globe and Mail's GlobeInvestor publishes RRB prices on a daily basis. You can also get RRB pricing at Canadian Fixed Income's RRB Offer Prices and Yields. While these numbers will vary somewhat from your broker's quotes, they're much more convenient to obtain. Here is the CFI quote from 04Dec09:

You can obtain the most authoritative RRB pricing by contacting the bond desk at your stock broker. The Globe and Mail's GlobeInvestor publishes RRB prices on a daily basis. You can also get RRB pricing at Canadian Fixed Income's RRB Offer Prices and Yields. While these numbers will vary somewhat from your broker's quotes, they're much more convenient to obtain. Here is the CFI quote from 04Dec09:

An RRB quote consists of two numbers, Real Price and Real Yield. You can determine the approximate market value of an RRB by multiplying the real price by the Index Ratio1. Using CFI's real price, 131.92, and the index ratio (based on the spreadsheet cited in the footnote), 1.38045, the price of the 01Dec21 4.25% RRB was $182.11. This means that for every $100 of face value you buy you'll pay approximately $182.11. In practice you'll pay somewhat more and, if you sell, you'll get somewhat less because your broker adds a commission on every transaction.

As with any bond, you must also add the interest that's accrued since the last coupon interest payment. You'll have to pay that if you're buying and you'll receive that much extra if you're selling.

What does the real yield mean?

What does the real yield mean?

This is the inflation-adjusted yield that you'll earn on an RRB that you buy now at the listed real price and hold to maturity. This represents the coupon rate (4.25% for the 2021 series in the example) discounted by the current real price (131.92 in the example.)

This is the inflation-adjusted yield that you'll earn on an RRB that you buy now at the listed real price and hold to maturity. This represents the coupon rate (4.25% for the 2021 series in the example) discounted by the current real price (131.92 in the example.)

How do I determine the value of an interest payment?

How do I determine the value of an interest payment?

All series of RRBs pay interest on June 1st and December 1st. For every $1,000 face value you'll receive an interest payment of $1,000 times half the coupon rate (e.g. 0.0425/2) times the then current index ratio.

All series of RRBs pay interest on June 1st and December 1st. For every $1,000 face value you'll receive an interest payment of $1,000 times half the coupon rate (e.g. 0.0425/2) times the then current index ratio.

How much will I get when my RRB matures?

How much will I get when my RRB matures?

When an RRB matures, you'll get the face (par) value times the then current index ratio. In other words, you'll get the face value indexed for inflation. This will probably be more than the original face value, but if there's been a period of deflation, it could be less.

When an RRB matures, you'll get the face (par) value times the then current index ratio. In other words, you'll get the face value indexed for inflation. This will probably be more than the original face value, but if there's been a period of deflation, it could be less.

Why are the index ratios different for different issues?

Why are the index ratios different for different issues?

The index ratio represents the cumulative effect of inflation since the bond's issue date. Since the bonds were issued at different times, they have different index ratios.

The index ratio represents the cumulative effect of inflation since the bond's issue date. Since the bonds were issued at different times, they have different index ratios.

Is there any inflation expectation incorporated in an RRB's price?

Is there any inflation expectation incorporated in an RRB's price?

Yes. This can be estimated by comparing the yield of a nominal bond with a similar maturity as the RRB. If the 01Dec21 RRB yields 3.79% and the closest nominal GoC bonds, the Jun 2021 and Jun 2022 bonds, yield 5.87% and 5.91% respectively, the implied nominal yield for the RRB is about 5.89% (the average of the two closest nominal bonds) and the inflation expectation is about 5.89%-3.79%, or 2.1%. If the average inflation rate from now until 2021 exceeds 2.1%, then the RRB will have been the better investment. Conversely if inflation is lower than 2.1%, the nominal bond will have been a better investment.

Yes. This can be estimated by comparing the yield of a nominal bond with a similar maturity as the RRB. If the 01Dec21 RRB yields 3.79% and the closest nominal GoC bonds, the Jun 2021 and Jun 2022 bonds, yield 5.87% and 5.91% respectively, the implied nominal yield for the RRB is about 5.89% (the average of the two closest nominal bonds) and the inflation expectation is about 5.89%-3.79%, or 2.1%. If the average inflation rate from now until 2021 exceeds 2.1%, then the RRB will have been the better investment. Conversely if inflation is lower than 2.1%, the nominal bond will have been a better investment.

Stripped RRBs

What are stripped RRBs?

What are stripped RRBs?

An RRB consists of a bond with a series of coupons for each of the semi-annual interest payments. For instance, a $1,000, 30-year 4.25% RRB consists of the $1,000 principal that matures in 30 years along with 60 coupons, due every six months, each of which pays $21.25. (Remember these are "real" amounts so you have to multiply by the then current index ratio to compute the actual payment.) Some securities dealers strip the coupons from RRBs, sell them individually, as well as selling the remaining principal (called the residual.) Note that each of the stripped coupons behaves just like the residual, i.e. they each make only a single payment at a specified date in the future.

An RRB consists of a bond with a series of coupons for each of the semi-annual interest payments. For instance, a $1,000, 30-year 4.25% RRB consists of the $1,000 principal that matures in 30 years along with 60 coupons, due every six months, each of which pays $21.25. (Remember these are "real" amounts so you have to multiply by the then current index ratio to compute the actual payment.) Some securities dealers strip the coupons from RRBs, sell them individually, as well as selling the remaining principal (called the residual.) Note that each of the stripped coupons behaves just like the residual, i.e. they each make only a single payment at a specified date in the future.

How would I use stripped RRBs in my portfolio?

How would I use stripped RRBs in my portfolio?

Strips are useful when you want to fund a specific future liability like retirement. With regular RRBs, you buy a large quantity of a single issue and sell a portion in each year of retirement. The disadvantage of this approach is that you assume the added risks of (a) reinvesting semi-annual interest payments at market rates and (b) realising market prices when you sell part of your holdings each year. With a stripped approach, you buy a ladder of individual coupons that mature throughout your planned retirement. You're guaranteed the real rate at the time of purchase regardless of market conditions, without the risk (and hassle) of reinvesting interest or selling at market prices.

Strips are useful when you want to fund a specific future liability like retirement. With regular RRBs, you buy a large quantity of a single issue and sell a portion in each year of retirement. The disadvantage of this approach is that you assume the added risks of (a) reinvesting semi-annual interest payments at market rates and (b) realising market prices when you sell part of your holdings each year. With a stripped approach, you buy a ladder of individual coupons that mature throughout your planned retirement. You're guaranteed the real rate at the time of purchase regardless of market conditions, without the risk (and hassle) of reinvesting interest or selling at market prices.

How else do stripped RRBs differ from "regular" RRBs?

How else do stripped RRBs differ from "regular" RRBs?

Strips usually have a slightly higher yield and a much higher volatility because they make no interest payments prior to maturity. And because of their lower liquidity you'll likely pay a higher spread if you need to sell them before they mature.

Strips usually have a slightly higher yield and a much higher volatility because they make no interest payments prior to maturity. And because of their lower liquidity you'll likely pay a higher spread if you need to sell them before they mature.

RRB Mutual Funds

Are RRB mutual funds a good substitute for RRBs?

Are RRB mutual funds a good substitute for RRBs?

There are now several mutual funds that invest primarily in RRBs. Because their MERs are above 1.5%, you can expect that a third or more of your returns will be eaten up by fund expenses. By contrast, if you buy an RRB from a broker and hold it to maturity, the commission you pay, amortized over 20 to 30 years, will be just a few basis points per year. RRB mutual funds may make sense if you have very small amounts to invest. Alternatively, consider "parking" your money in a money market or short-term bond fund until you have enough to buy an RRB.

There are now several mutual funds that invest primarily in RRBs. Because their MERs are above 1.5%, you can expect that a third or more of your returns will be eaten up by fund expenses. By contrast, if you buy an RRB from a broker and hold it to maturity, the commission you pay, amortized over 20 to 30 years, will be just a few basis points per year. RRB mutual funds may make sense if you have very small amounts to invest. Alternatively, consider "parking" your money in a money market or short-term bond fund until you have enough to buy an RRB.

In late 2005, Barclays Canada introduced a Real Return Bond Index ETF (symbol XRB) that provides the same benefits as conventional RRB mutual funds but charges an MER of only 0.35%.

Why have RRBs and RRB mutual funds done so well recently?

Why have RRBs and RRB mutual funds done so well recently?

Following the burst of the equity markets bubble in 2000, many investors fled to the relative safety of the bond markets. This drove up bond prices and made it possible for RRBs to achieve double-digit annual returns. Like all trends this cannot continue indefinitely. RRB prices will very likely correct as equity markets recover. If you buy RRBs, make sure that the current real yield-to-maturity meets your needs and plan to hold them until maturity.

Following the burst of the equity markets bubble in 2000, many investors fled to the relative safety of the bond markets. This drove up bond prices and made it possible for RRBs to achieve double-digit annual returns. Like all trends this cannot continue indefinitely. RRB prices will very likely correct as equity markets recover. If you buy RRBs, make sure that the current real yield-to-maturity meets your needs and plan to hold them until maturity.

Taxation of RRBs

How are RRBs taxed?

How are RRBs taxed?

Like nominal bonds, RRB interest is taxed as ordinary income at your marginal tax rate. Inflation adjustments are also taxed annually as ordinary income as they accrue even though you won't receive them until the bond matures, possibly many years later.

Like nominal bonds, RRB interest is taxed as ordinary income at your marginal tax rate. Inflation adjustments are also taxed annually as ordinary income as they accrue even though you won't receive them until the bond matures, possibly many years later.

Where should I hold RRBs?

Where should I hold RRBs?

RRBs are best held inside an RRSP, RRIF or other tax-sheltered account because of the way they are taxed.

RRBs are best held inside an RRSP, RRIF or other tax-sheltered account because of the way they are taxed.

Buying and selling RRBs

Where can I buy RRBs?

Where can I buy RRBs?

Most full service and discount brokers offer RRBs. (In the US, individual investors can purchase inflation-indexed bonds directly from the Treasury.)

Most full service and discount brokers offer RRBs. (In the US, individual investors can purchase inflation-indexed bonds directly from the Treasury.)

What does it cost to buy an RRB?

What does it cost to buy an RRB?

As with all bonds, a sales commission is built into the spread between the price you pay to buy a bond and the price you get when you sell the same bond. The size of the spread depends on how large a purchase you make (typically the minimum is $5,000 face value), the specific dealer as well as a variety of other factors like a bond's liquidity, its term to maturity and even your relationship with your broker. (TD's website says that a "key benefit" of RRBs is their "high degree of liquidity," however since they repesent only a few percent of federal debt and most are institutionally owned, they're unlikely to be as liquid as nominal bonds.)

As with all bonds, a sales commission is built into the spread between the price you pay to buy a bond and the price you get when you sell the same bond. The size of the spread depends on how large a purchase you make (typically the minimum is $5,000 face value), the specific dealer as well as a variety of other factors like a bond's liquidity, its term to maturity and even your relationship with your broker. (TD's website says that a "key benefit" of RRBs is their "high degree of liquidity," however since they repesent only a few percent of federal debt and most are institutionally owned, they're unlikely to be as liquid as nominal bonds.)

You can calculate the approximate value of this accrued interest by multiplying the number of days since the last interest payment divided by the number of days in the year, times the coupon rate, times the index ratio. For instance, if you buy a $1,000 face value RRB 30 days after the last interest payment, the accrued interest will be approximately $1,000 x 30/365 x 0.0425 x 1.185 = $4.14. (Of course if you buy an RRB immediately after an interest payment has been paid then there will be no accrued interest.)

As with regular RRBs, confirm that the information you're quoted is plausible. Using the bond calculator (see previous question), for Price use Current market price divided by Index ratio and for Coupon rate use 0 (since there are no coupons.)

Note that when a broker strips RRBs they have some 20 to 30 times as much in residuals as in individual coupons. For that reason it's much easier to buy the principal residual than a specific coupon.

What is accrued interest?

What is accrued interest?

When you buy an RRB some of the interest that you'll get at the next semi-annual payment date has accrued on behalf of the seller. You'll be required to compensate the seller for this interest, but you'll get it all back in the next interest payment.

When you buy an RRB some of the interest that you'll get at the next semi-annual payment date has accrued on behalf of the seller. You'll be required to compensate the seller for this interest, but you'll get it all back in the next interest payment.

How do I buy an RRB?

How do I buy an RRB?

Use this checklist to ensure that you have all the information you need to make an informed purchase.

Use this checklist to ensure that you have all the information you need to make an informed purchase.

How do I buy stripped RRBs?

How do I buy stripped RRBs?

Strips sell at a discount to face value because the interest accrues rather than being paid out prior to maturity. For instance, if your broker quotes a price of $71.32, a $10,000 face value strip will cost $7,132, but when it matures you'll get $10,000 times the then current index ratio. This mechanism is the same whether you buy individual coupons or the residual.

Strips sell at a discount to face value because the interest accrues rather than being paid out prior to maturity. For instance, if your broker quotes a price of $71.32, a $10,000 face value strip will cost $7,132, but when it matures you'll get $10,000 times the then current index ratio. This mechanism is the same whether you buy individual coupons or the residual.

Can I sell RRBs before they mature?

Can I sell RRBs before they mature?

Yes. See "What does it cost to buy an RRB?" You'll get the market price, less the broker's spread plus any accrued interest.

Yes. See "What does it cost to buy an RRB?" You'll get the market price, less the broker's spread plus any accrued interest.

Real Return Bond Summary [Department of Finance] Links

Links

A quick reference on how to determine the nominal values of interest payments and the final principal repayment of an RRB.

Tax Treatment Of Government Of Canada Securities [Department of Finance]

A summary of how RRBs are taxed, including coupon interest, accrued inflation compensation and capital gains/losses on disposition.

Canada Real Return Bonds ![]() [Bank of Canada]

[Bank of Canada]

Essentially a simplified prospectus from the issuer

Real Return Bonds [finiki • Do-It-Yourself Financial Webring Wiki]

Financial Webring Forum

There are several discussions about real return bonds. Login as a Guest (or register), then Search for threads that contain the Keyword real. Select "Search topic title only."

The bond that beats inflation [Financial Post, 07May02]

A hot topic for knowledgeable do-it-yourself investors is real-return bonds (RRBs), which are inflation-indexed Government of Canada bonds

Government Of Canada Real Return Bonds [TD Canada Trust]

A brief summary of RRBs by one of the principal dealers in the bond market.

Nominal bonds, indexed bonds, or some of each? [Libra Investment Management]

A couple of intriguing charts to help you decide how to divide your portfolio between RRBs and nominal bonds.

TD Real Return Bond [TD Canada Trust]

The first Canadian RRB mutual fund. Beware of the high management expense ratio (MER).

iUnits Real Return Bond Index ETF (XRB) [BlackRock Canada]

"[XRB] seeks to provide income by replicating, to the extent possible, the performance of the DEX Real Return Bond Index, net of expenses." The MER is 0.35%.

BMO Real Return Bond Index ETF (ZRR) [BMO]

"[ZRR] has been designed to replicate, to the extent possible, the performance of the DEX RRB Non Agency Bond Index, net of expenses." The MER is 0.25%.

US TIPS FAQs

Can Canadians buy US TIPS?

Can Canadians buy US TIPS?

Yes. For example, in late December 2001, TD Waterhouse Canada offered US TIPS maturing in 2011 (yield 3.40%) and 2028 (yield 3.43%.) Contact your broker for more information.

Yes. For example, in late December 2001, TD Waterhouse Canada offered US TIPS maturing in 2011 (yield 3.40%) and 2028 (yield 3.43%.) Contact your broker for more information.

Can Canadians buy US TIPS from the US Treasury?

Can Canadians buy US TIPS from the US Treasury?

Yes--but! Unfortunately, there does not seem any way to hold directly-bought bonds inside an RRSP or other tax-sheltered account, so this option is impractical for tax reasons.

Yes--but! Unfortunately, there does not seem any way to hold directly-bought bonds inside an RRSP or other tax-sheltered account, so this option is impractical for tax reasons.

Can I hold US TIPS in my RRSP or other tax-sheltered account?

Can I hold US TIPS in my RRSP or other tax-sheltered account?

Yes.

Yes.

Links

Links

Since the structure of US Treasury Inflation-Indexed Securities (TIPS) is similar to Canadian Real Return Bonds much of the following material also applies to Canadians. Note however one important difference:TIPS, unlike Canadian RRBs, guarantee that the principal repayment at maturity is not less than the original issue value. And of course, keep in mind that the two countries have different tax regulations.

TIPS Current Prices and Yields

Bond Quotes • Tables • Charts [Vanguard]

TIPS Quotes [WSJ]

Bond Quotes [Bloomberg]

Inflation-Indexed Securities [US Treasury Department]

A wealth of general information, historical data and tax treatment for US residents.

The Dark Side Of TIPS

Rick Ferri • Forbes • 04Dec09

"Inflation-indexed bonds are often described as the ultimate risk-free investment... However, there is another side to this story that is rarely discussed... Real interest rate increases are not the same as inflation-based interest rate increases."

The World's 'Safest' Investments Still Carry Risk of Painful Losses

Jonathan Clements • Wall Street Journal • 27Aug03

"Inflation-indexed Treasury bonds are possibly the market's safest investment. But you could still suffer stinging losses...The fact is, inflation bonds can post nasty short-term losses...Even if you can shrug off this volatility, you face a second headache. Every year, investors have to pay income taxes on both the yield they receive and the inflation-driven increase in their bonds' principal value."

The Case for Inflation Indexed Bonds ![]()

Peter James Lingane • Financial Security by Design • Mar02

A nice summary of inflation-index bonds, including both TIPS and I-Bonds. Discusses how they work, their strengths and weaknesses, and how they fit into your portfolio.

Can TIPS Help Identify Long- Term Inflation Expectations? ![]()

Pu Shen and Jonathan Corning • Federal Reserve Bank of Kansas City • 4Q01

The yield spread between conventional and inflation indexed Treasuries contains useful information about market expectations of future inflation [but] it will always be advisable to combine yield spreads with other information to best estimate [them.]

Features and Risks of Treasury Inflation Protection Securities ![]()

Pu Shen • Federal Reserve Bank of Kansas City • 1Q98

"discusses the features and risks of the Treasury inflation indexed bonds ... explains why these bonds can benefit many investors ...shows how the tax code prevents these bonds from being entirely inflation-risk free."

Inflation-Indexed Bonds: How Do They Work? ![]()

Jeffrey M. Wrase • Federal Reserve Bank Of Philadelphia • Jul/Aug97

"provides a simple description of the new inflation-protection bonds. We’ll consider why indexed bonds can be useful to investors, to the Treasury, and to policymakers in the Federal Reserve."

Privately-issued US Inflation-Indexed Bonds

Inflation-Linked Investment Options describes IFCDs (Inflation-Floater Certificates of Deposit), Corporate Notes and CDIPs (Certificates of Deposit Inflation-Protected) as well as TIPS and I-Bonds.Inflation-protected InterNotes [IPI] are corporate bonds designed for individual investors. They pay interest each month that's made up of two parts: a fixed amount disclosed when you buy the bond, and an inflation-adjusted amount. At maturity, you get back your original investment.

Links

Links

The French treasury has introduced Euro-denominated inflation-indexed bonds called OAT€i. These bonds are backed by the French government (as opposed to the European Union) but they're indexed to the Eurozone consumer price index. They may be useful to people who want to fund future visits to or retirement in Europe. (The French treasury also offers, OATi, which are Euro-denominated bonds that are linked to the French consumer price index.)

Agency France Trésor [in English]

French Treasury Department website

La Caisse d'Amortissement de la Dette Sociale (CADES) [in English]

French Social Security Debt Repayment fund. Issues French Franc denominated inflation-indexed bonds.

iShares € Inflation Linked Bond ![]() [BGI UK • Nov05]

[BGI UK • Nov05]

"The investment objective of this fund is to provide investors with a total return, taking into account both capital and income returns, which reflects the return on the government-inflation linked bonds of the EMU."

Links

Links

The Bank of England issues index-linked Gilts denominated in sterling "on which both the interest payment and the capital repayment on redemption are adjusted in line with inflation (as measured by the Retail Prices Index, or RPI). ... Index-linked gilts may be particularly attractive to UK taxpayers since, under current legislation, the gain arising from the inflation uplift is generally not taxed in the hands of UK private investors. They will, however, be taxable on the full amount of interest received including any inflation uplift."

UK Debt Management Office (DMO)

"The DMO’s brief is to carry out the Government’s debt management policy of minimising financing costs over the long term"

Index-linked Savings Certificates [National Savings and Investments]

Inflation-beating savings – with no tax to pay. With our inflation-beating Index-linked Savings Certificates, the value of your investment increases in line with inflation and earns guaranteed interest rates – with all your returns tax-free. So you can be sure to keep ahead of rising prices.

UK Index-Linked Gilts [DMO]

Comprehensive information about Gilts and related data.

Links

Links

Treasury Indexed Bonds will be issued only as capital-indexed bonds with the capital value of the investment being adjusted by the rate of inflation. Interest will be paid quarterly, at a fixed rate, on the adjusted capital value. At maturity, investors will receive the inflation-adjusted capital value of the security - the value as adjusted for inflation over the life of the bond.

Reserve Bank of Australia

Prospectus: Treasury Indexed Bonds

Links

Links

Treasury Bonds are non-callable bullet bonds with maturity up to about 13 years. They are index-linked to the Icelandic Consumer Price Index.

www.bonds.is [National Debt Management Agency]

Links

Links

Inflation-linked bonds have an inflation-secured return and are either yearly or zero coupon bonds. Interest and inflation compensation for zero coupon bonds are paid at redemption. Nominal amount and coupons are added with inflation, which entails that future cash flow will always keep the real purchasing power. The bonds are linked to the Swedish consumer price index (CPI), with an indexation lag of three months. At redemption, the Debt Office refunds the nominal amount adjusted for inflation.

Swedish National Debt Office

Inflation-linked bonds

More Links

A potpourri of related links about inflation-indexed bonds from around the world.

Diversification Benefits of Treasury Inflation Protected Securities: An Empirical Puzzle ![]()

Abdullah Mamun & Nuttawat Visaltanachoti • Feb06

"We conclude that TIPS will essentially be an addition to long term investors’ portfolios to provide diversification benefits; however, it will not replace equity, Treasury bonds, investment grade corporate bonds, or real estate completely in a diversified portfolio."

Asset Allocation with Inflation-Protected Bonds

S.P. Kothari & Jay Shanken • Jan/Feb04

"We found that the real (inflation-adjusted) returns on indexed bonds are less volatile than the returns on otherwise similar conventional bonds. Moreover, the correlation with stock returns is much lower for the indexed bonds. An examination of asset allocation among stocks, indexed bonds, conventional Treasuries, and a riskless asset suggests that substantial weight should be given to indexed bonds in an efficient portfolio."

The Invention Of Inflation-Indexed Bonds In Early America ![]()

Robert Shiller • Cowles Foundation • Oct03

"The world’s first known inflation-indexed bonds were issued by the Commonwealth of Massachusetts in 1780 during the Revolutionary War. These bonds were invented to deal with severe wartime inflation and with angry discontent among soldiers in the U.S. Army with the decline in purchasing power of their pay."

The Inflation-Linked House [Barclays Capital]

A website devoted to inflated-linked securities from around the world. See especially Value Snapshot ("a quick current perspective on inflation-linked bond markets, giving year-ahead consensus forecasts for inflation, plus comparisons with nominal bonds, equities and money market rates. ") Note: some pages are password-protected.

Barclays Global Inflation-linked Bond Index Guide ![]()

A Closer Look at Helping Employees Better Manage Investment Risk

Wharton School • May02

"There’s a lot of talk going on now in policy circles in Congress about how to improve the risk reduction possibilities open to people in the wake of Enron and similar problems," [Zvi Bodie] said. The lack of attention paid to inflation-protected bonds "strikes me as an incredible failure of public policy."

TIPS -- in Case Everyone's Wrong About Inflation

Washington Post • 03Mar02

Summary of TIPS and other US inflation-indexed securities including I-bonds and mutual funds.

Determinants of demand for inflation-indexed bonds ![]()

CDC IXIS via CADES • 18Jun01

"We examine the theory and practice of the determinants of demand for inflation-indexed bonds, relative to demand for nominal bonds."

Optimal Asset Allocation: The Contribution Of Inflation-Linked Bonds ![]()

CDC IXIS via CADES • 17Mar01

"Conclusion: the analysis of the historical data highlights the attractiveness of inflation-linked bonds in an optimal portfolio allocation"

Strategic Asset Allocation: Portfolio Choice for Long-Term Investors

John Y. Campbell • Fall 2000

"Conservative long-term investors who are concerned about the possible return of inflation should hold U.S. Treasury inflation-indexed bonds"

Inflation indexed Securities - Description and market Experience ![]()

AARP Public Policy Institute • Aug00

"Despite their potential advantages, the market for inflation-indexed securities has been slow to develop since their introduction in 1997. In exploring why individuals haven’t been buying them, Alison Shelton of AARP’s Public Policy Institute focuses primarily on small investors. "

A Bond Anybody Can Love

BusinessWeek • 19Jun00

"[Jeremy] Siegel, the Wharton School economist whose book, Stocks for the Long Run, underpins today's buy-and-hold-equities creed, turns out to love a crazy little thing called TIPS."

Are Real Return Bonds Still an Attractive Alternative? ![]()

National Bank • 06Mar00

RRBs remain an attractive alternative. If, on the one hand, the [bond] market does well, so will RRBs, though to a lesser extent. On the other hand, if the market does poorly, RRBs will offset losses. Having said this, the more uncertain the bond market outlook, the more weight should be given to RRBs in portfolios.

Asset Allocation with Conventional and Indexed Bonds ![]()

S.P. Kothari & Jay Shanken • 01Mar00

"These observations suggest an important role for indexed bonds in a diversified investment portfolio. The risk-reduction benefits of indexed bonds reflect fundamental economic relations and are likely to persist in the future."

Inflation-Indexed Treasury Bonds: Cash Flows, Taxes and Simulated Returns

Journal of Financial Planning • Apr99

"The purpose of this paper is to evaluate the risk-and-return features of TIPS relative to conventional fixed-rate bonds. Special attention is given to the tax treatment of TIPS, inflation conditions under which TIPS outperform conventional fixed-rate bonds and conditions where the interaction of inflation and taxes result in negative real after-tax returns."

These Bonds Looked Like Losers. They're Not

BusinessWeek • 05May97

"When the Clinton Administration un-veiled plans last year to offer "inflation-indexed" bonds, some Wall Street wags likened the proposal to peddling flood insurance in the desert."

Index Treasuries will spawn new trust products

ABA Banking Journal • Apr97

Summary of TIPS including sample calculations of principal value and interest payments.

Retirement Planning Issues

Inflation-indexed bonds play an important part in the asset allocation decisions of those who are, or are soon to be, retired because they help protect their nest-eggs from the ravages of inflation.

Zvi Bodie and Michael Clowes, Worry-Free Investing. ISBN 0130499277, Financial Times Prentice Hall, 2003

A practical explanation of how to use inflation-indexed bonds and annuities to assure a financially secure retirement. (Related papers by Zvi Bodie are available at SSRN.)

FIRECalc: How long will the money last?

"Cap'n Bill" • Apr01

A simple retirement withdrawal calculator that includes TIPS as an asset class.

Glossary

- face value

- the amount that an issuer agrees to pay at the maturity date; with inflation-indexed bonds face value changes according to the index ratio [same as par value]

- index ratio1

- the reference CPI applicable to the current date, divided by the reference CPI for the original issue date

- nominal

- unadjusted for inflation [see real]

- par value

- the amount that an issuer agrees to pay at the maturity date; with inflation-indexed bonds par value changes according to the index ratio [same as face value]

- real

- adjusted for inflation [see nominal]

- real price

- the market balue of a bond including the accrued inflation adjustment

- real yield

- the effective rate of interest paid on a bond adjusted for inflation

Acknowledgements

The contributions to this page by several posters on TheBoomer Discussion Forum, especially "Shakespeare" and Graham Cook, are gratefully appreciated. That forum is now defunct, but if you'd like to discuss RRBs and related issues, join us on the Financial Webring Forum. Search for threads whose title includes "real".We get reviews:

- "Great website! I will have to add it to the next edition of WFI."

...Prof. Zvi Bodie [11Jul03] - "When I bought RRBs through a discount broker, the salesperson had to call me back after lengthy deliberations about the details. 'These things are horribly complicated,' she said. 'Thank goodness someone pointed me to the information at www.bylo.org!'"

...from a post on TheBoomer

Footnotes

1. The index ratio that you'll be quoted by a broker is based on the settlement date, three trading days later, rather than the date you place the trade.For those who want to calculate index ratios from published CPI data, an Excel spreadsheet is available here courtesy of "Shakespeare". (To download the spreadsheet, right-click the link, then "Save Link As..." [Firefox/Netscape] or "Save Target As..." [Internet Explorer].)